How It Works

Get a glimpse of the full AlgoPro suite

Tools for every style of trader.

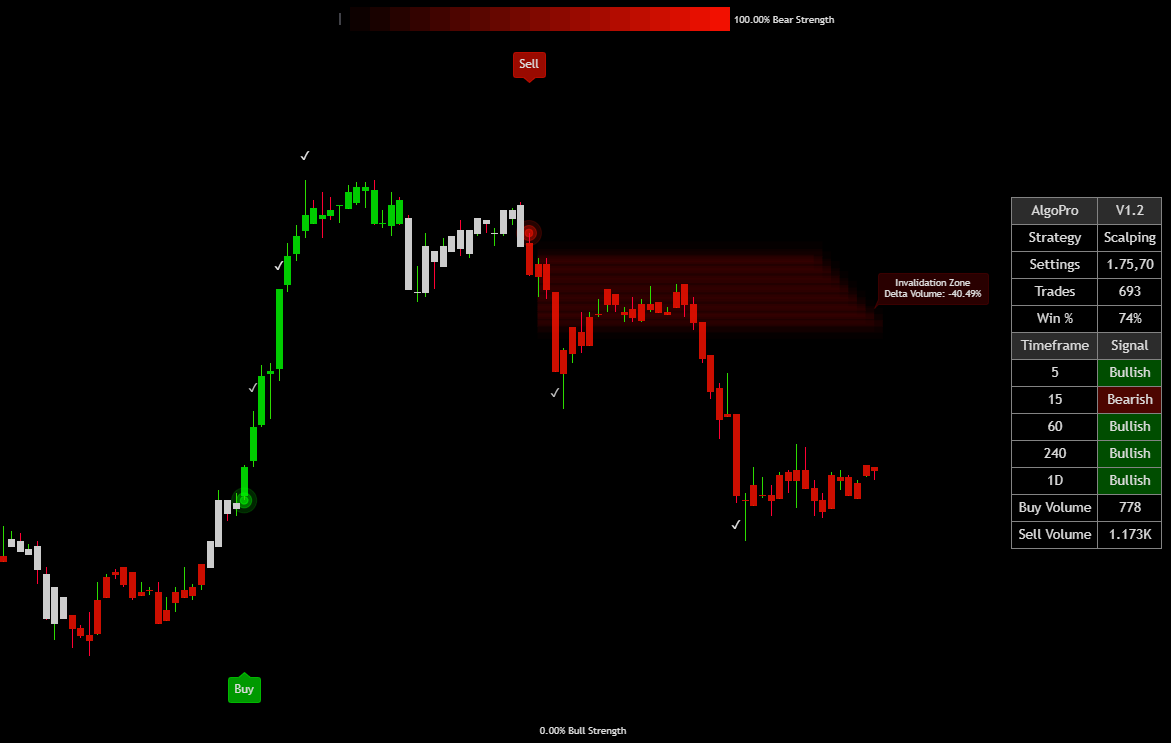

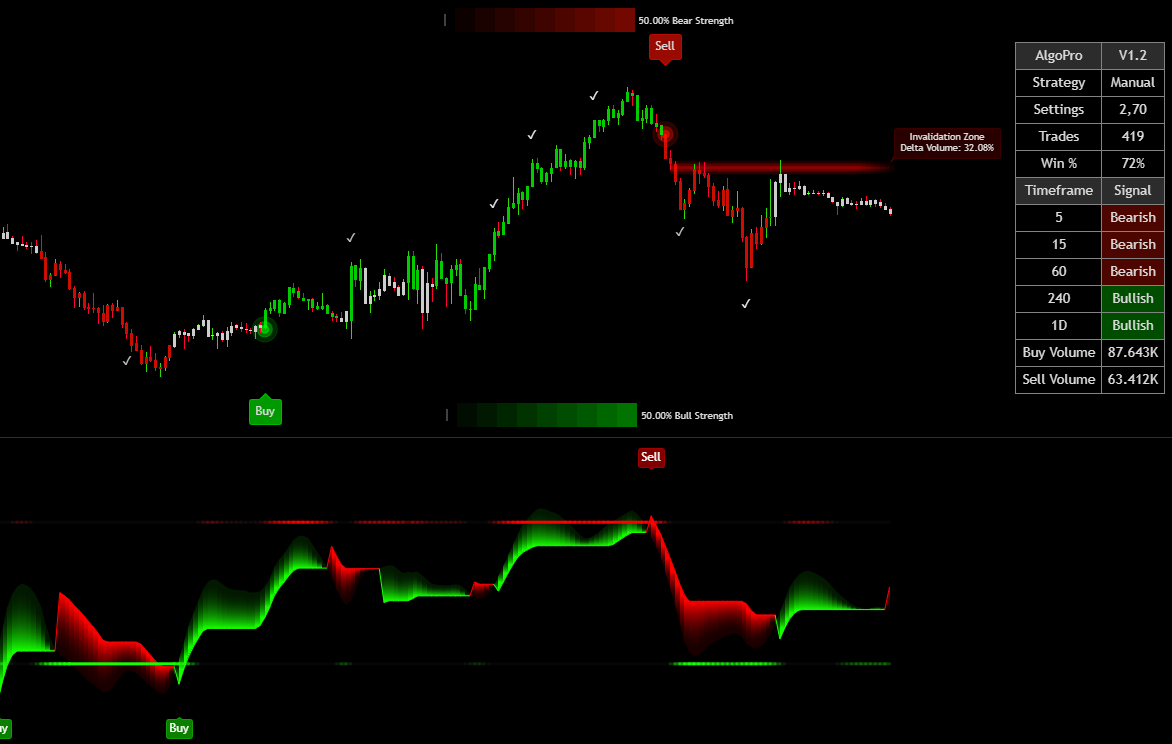

AlgoPro V1.2

AlgoPro V1.2 is our entry-level trading tool for new traders on TradingView. It’s designed to make your trading journey easier, safer, and more structured, without overwhelming you with complexity. This tool helps you spot potential entries with simple built in presets like scalping, day trading, or swing trading – all while managing the trade with smart take profit markers and volume invalidation zones.

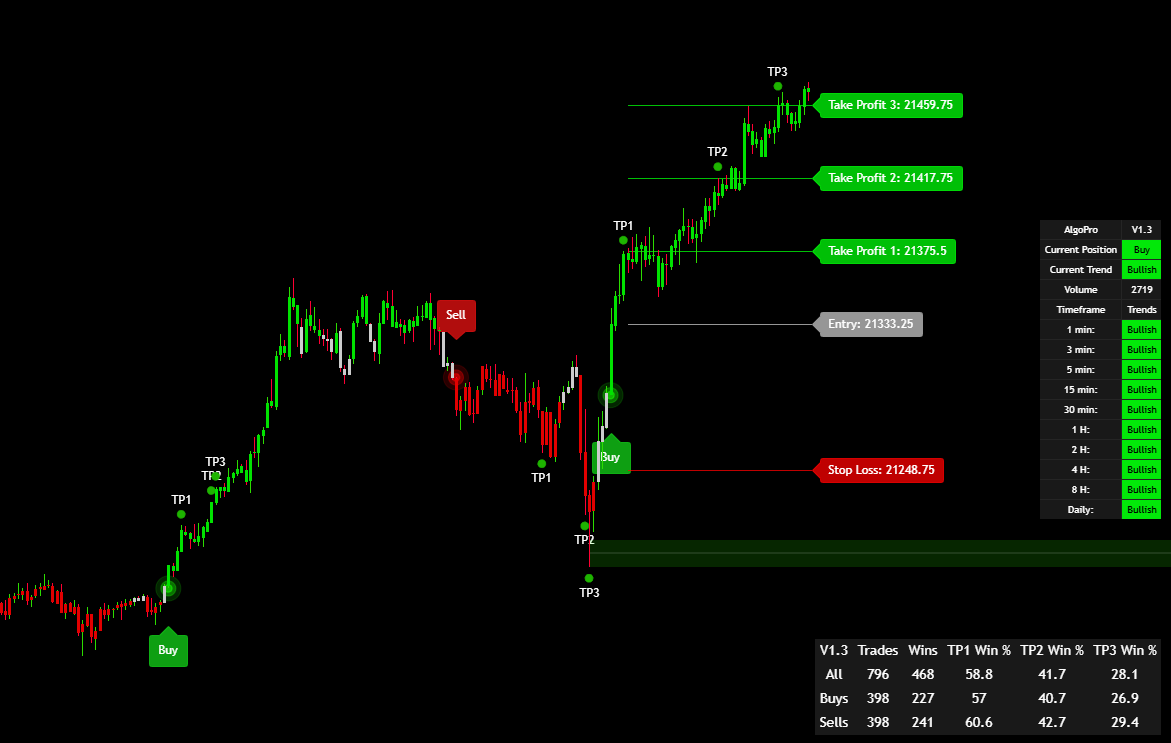

AlgoPro V1.3

AlgoPro V1.3 is a step up as far as complexity goes and lets you customize your signals for exactly your trading style. With up to 50 popular technicals and indicator sources to choose from, you can tune and tweak your signals like never before. All complete with a dynamic take profit and stop loss system to safely manage your trades.

AlgoPro V1.4

AlgoPro V1.4 is our system that aims to simplify complex algorithms into few settings. While not as simple as V1.2, yet not as complex as V1.3, V1.4 finds the perfect balance of allowing you to fine tune advanced algorithms to power up your trading without being overwhelmed. Complete with timeframe presets and a dynamic take profit and stop loss system.

AlgoPro V1.5

AlgoPro V1.5 aims to take all of the work out of your hands. With a revolutionary auto-optimization engine, users don’t need to manually test and tweak settings; the tool does it for them, continuously finding the best configurations for maximum profitability. The perfect tool for spotting easy swing trades.

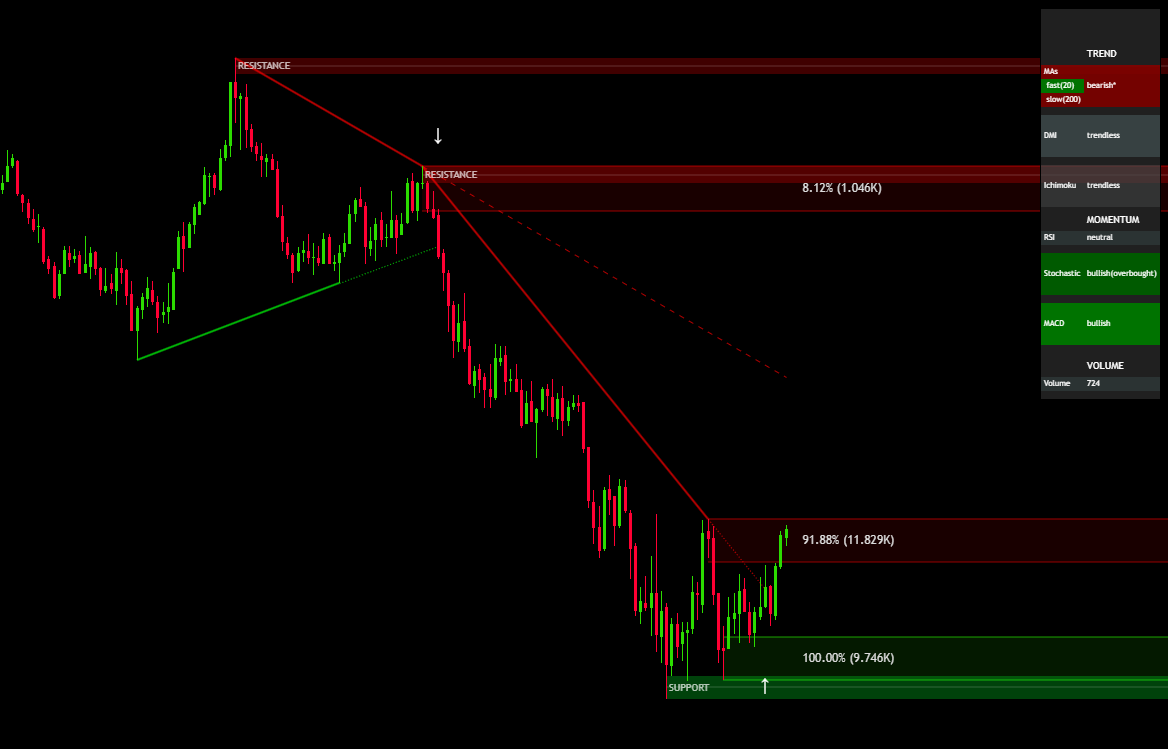

AlgoPro Support & Resistance

The AlgoPro Support & Resistance Tool is a comprehensive indicator for identifying key support and resistance levels based on historical price swings. This tool is enhanced with features such as supply and demand, volume order blocks, smart trendline analysis, and a market dashboard for real-time tracking so you’re always in tune with what’s happening.

AlgoPro Market Matrix

AlgoPro Market Matrix is an advanced trading tool designed to guide traders in identifying the most opportune moments to enter and exit trades. By analyzing key factors such as price action, volume, and overall market dynamics, Market Matrix provides a comprehensive view of market conditions, key breaks of levels, potential reversal warnings, and a dashboard to let you know what technicals may be warning a reversal in price.

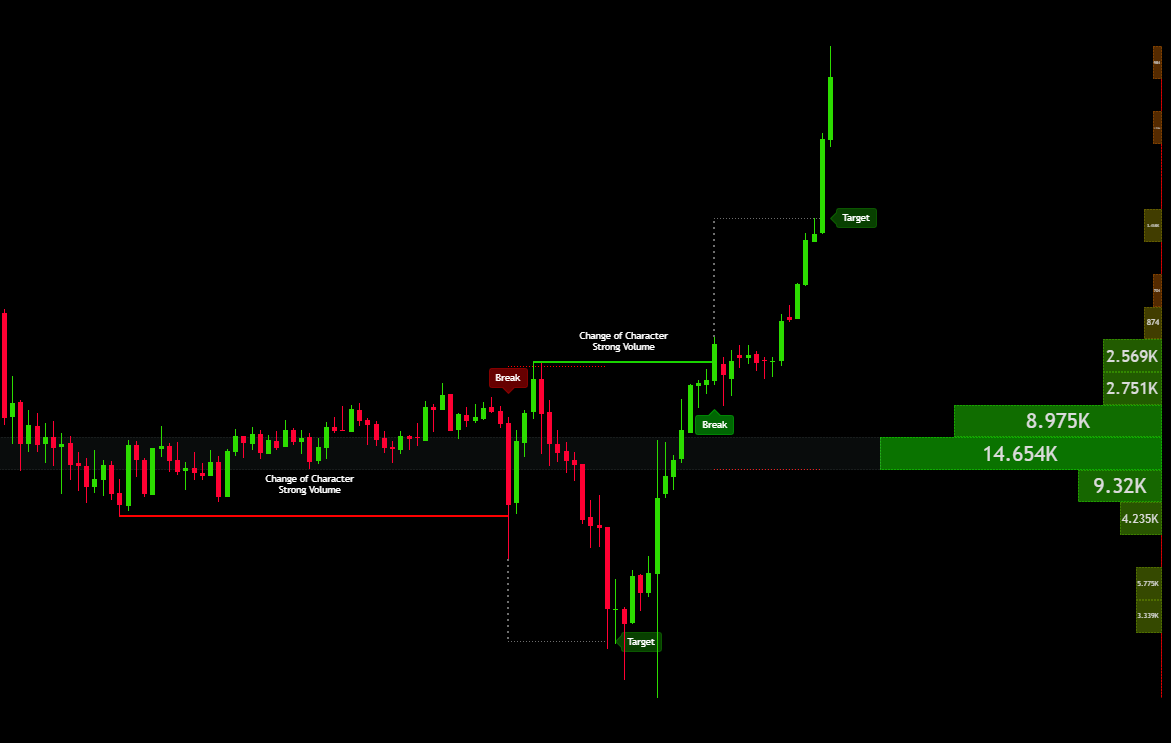

AlgoPro Smart Money Concepts

The AlgoPro Smart Money Concepts tool simplifies SMC trading – turning smart money methods into a real time trading system, you’ll get real time entries from key breaks of character or market structure. These breaks of character and market structure are also tracked with volume at the time those areas are detected. Complete with target levels that align with current market conditions.

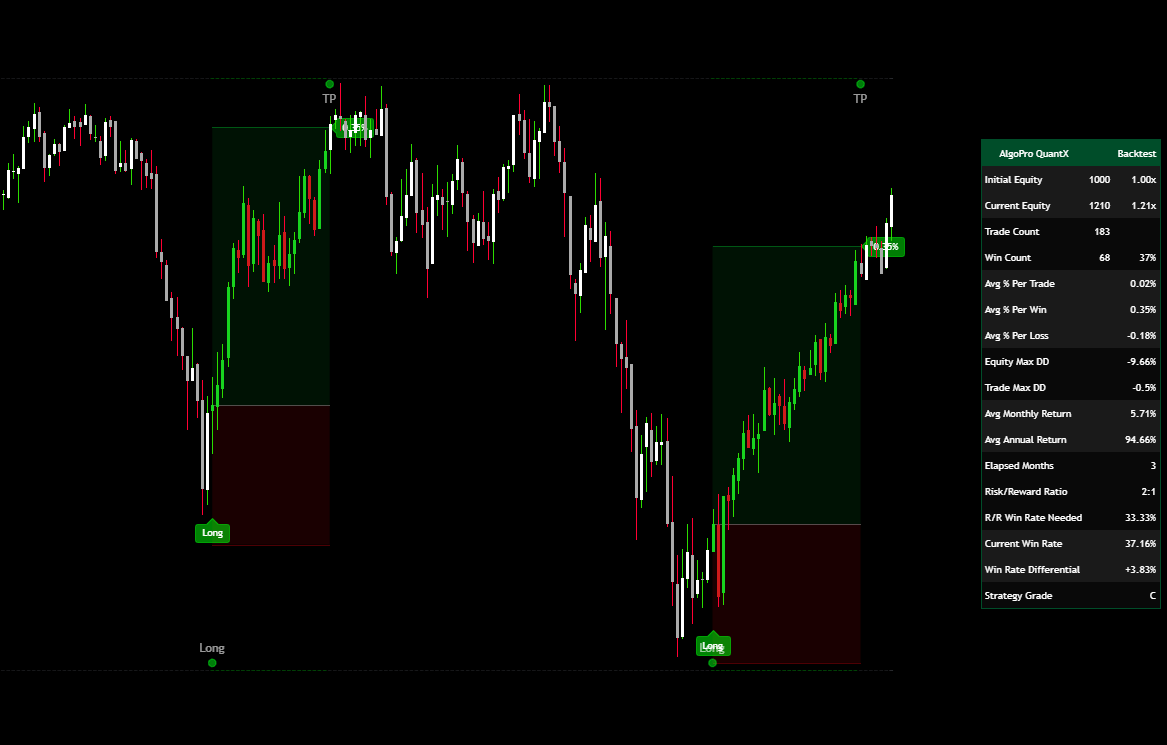

AlgoPro QuantX

AlgoPro QuantX is a powerful trading tool designed to mix things up as a contrarian system trading against the trend. Changing how traders approach the market by leveraging a confluence of signals for precision entries. QuantX waits for multiple favorable conditions and trading concepts to align before triggering trades, ensuring higher confidence in each possible reversal.

AlgoPro V3 Oscillator

The AlgoPro V3 is a complex oscillator that takes reversal signals, RSI, Moving Averages, and trend confluence to help confirm potential entries. As price overextends beyond the RSI thresholds of the V3, our algorithm looks for all other signals to be confirmed to signal a potential entry in the market. The perfect tool to use as confluence to confirm entries or exits.

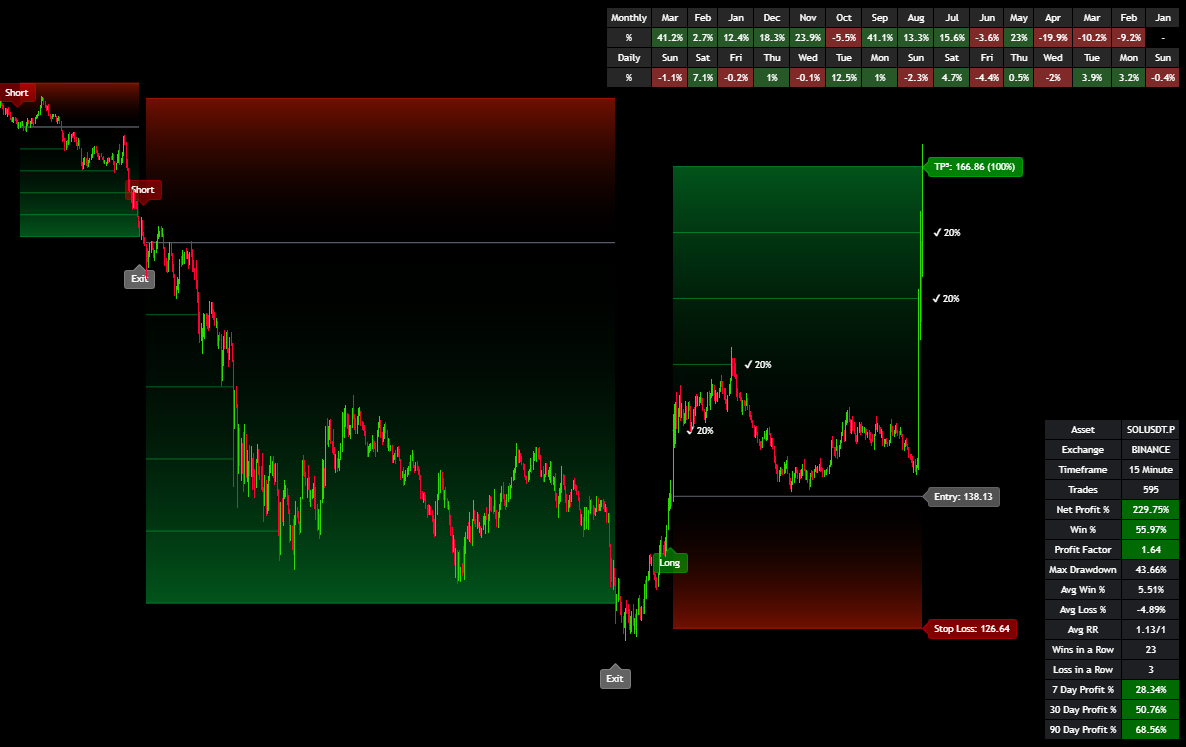

AlgoPro QuantFlow

AlgoPro QuantFlow is the introductory tool into our advanced trading strategies. Using a simple, yet complex algorithm in detecting key breaks of price levels paired with our state of the art take profit and stop loss system where you can choose any exit conditions you could imagine, from swing trading – to scalping. Our strategy systems are as comprehensive as it gets. Find already optimized strategies for this system at our AlgoPro Strategy Lab.

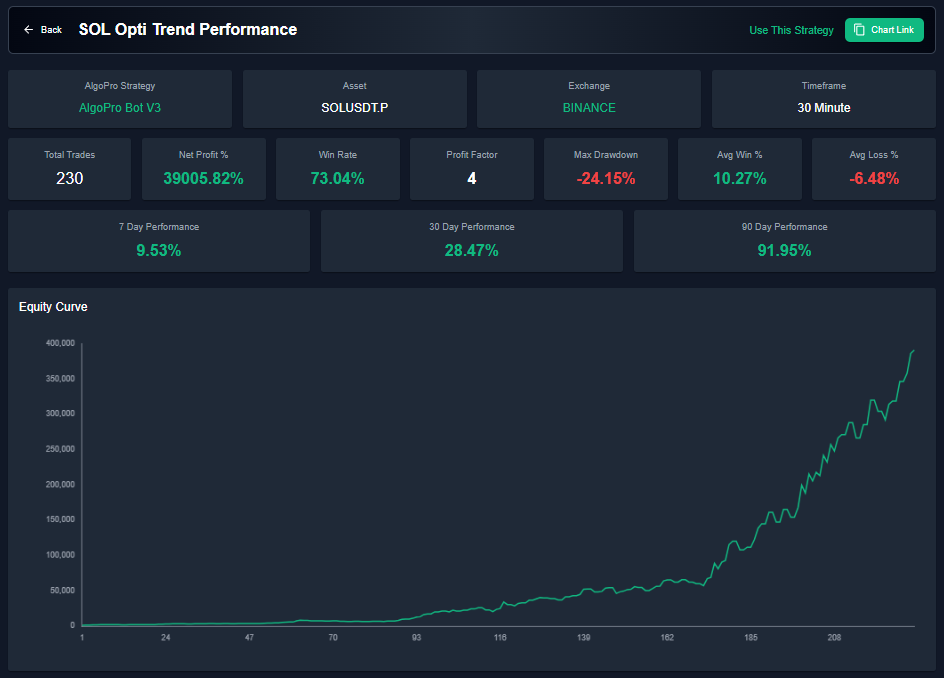

AlgoPro Bot V3

The AlgoPro V3 Bot takes creating advanced TradingView strategies to another level. Fine tune your signals exactly how you want with over 50 options to choose from – exit a trade exactly as you desire with the most complex exit conditions available on any strategy on the TradingView platform. No matter your trading style, a strategy can be created using this system. Find already optimized strategies for this system at our AlgoPro Strategy Lab.

AlgoPro Strategy Lab

The AlgoPro Strategy Lab is a cutting-edge platform designed to track custom trading strategies for various assets and markets in real time from our TradingView strategies like Bot V3 and QuantFlow – where members can use the strategies with the click of a button. It offers detailed performance metrics for each strategy, giving users valuable insights into their effectiveness and profitability. As the Strategy Lab is brand new, we’re still working on adding strategies to the platform. A starting batch has already been added, but we will be continuously adding optimized strategies daily/weekly – aiming at making the strategy lab the capital of finding the most profitable strategies on TradingView.